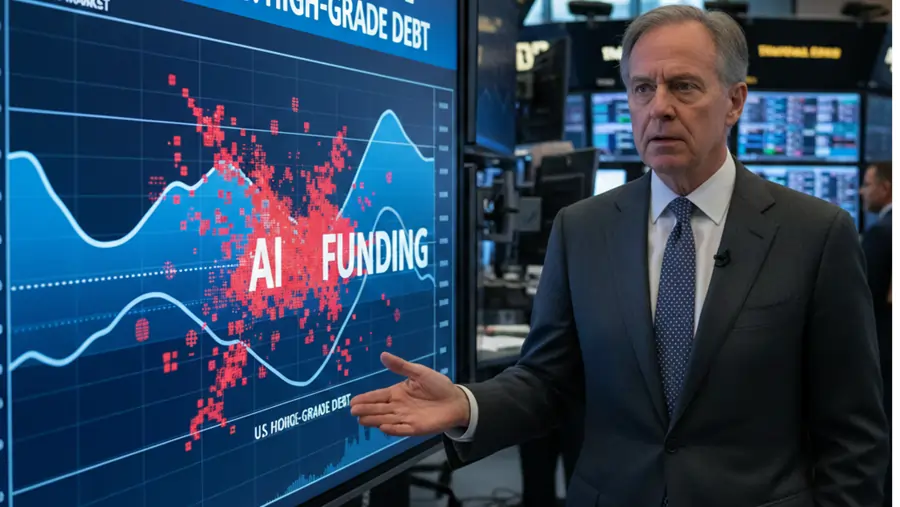

Investment firm DoubleLine has warned that the growing wave of AI-driven funding could significantly impact the U.S. high-grade debt market. Executives cautioned that surges in capital directed toward AI ventures may alter risk dynamics and affect yields in traditionally stable debt sectors.

Key Highlights:

DoubleLine’s analysts suggest that rapid inflows into AI-related projects may create volatility in corporate bond pricing.

The firm is monitoring how AI funding trends could shift investment strategies for high-grade debt securities.

Experts note that while AI presents growth opportunities, it may also introduce uncertainty for conservative debt investors seeking stable returns

Stay updated with key breakthroughs, market shifts, and innovations as AI and Tech.